how to claim eic on taxes

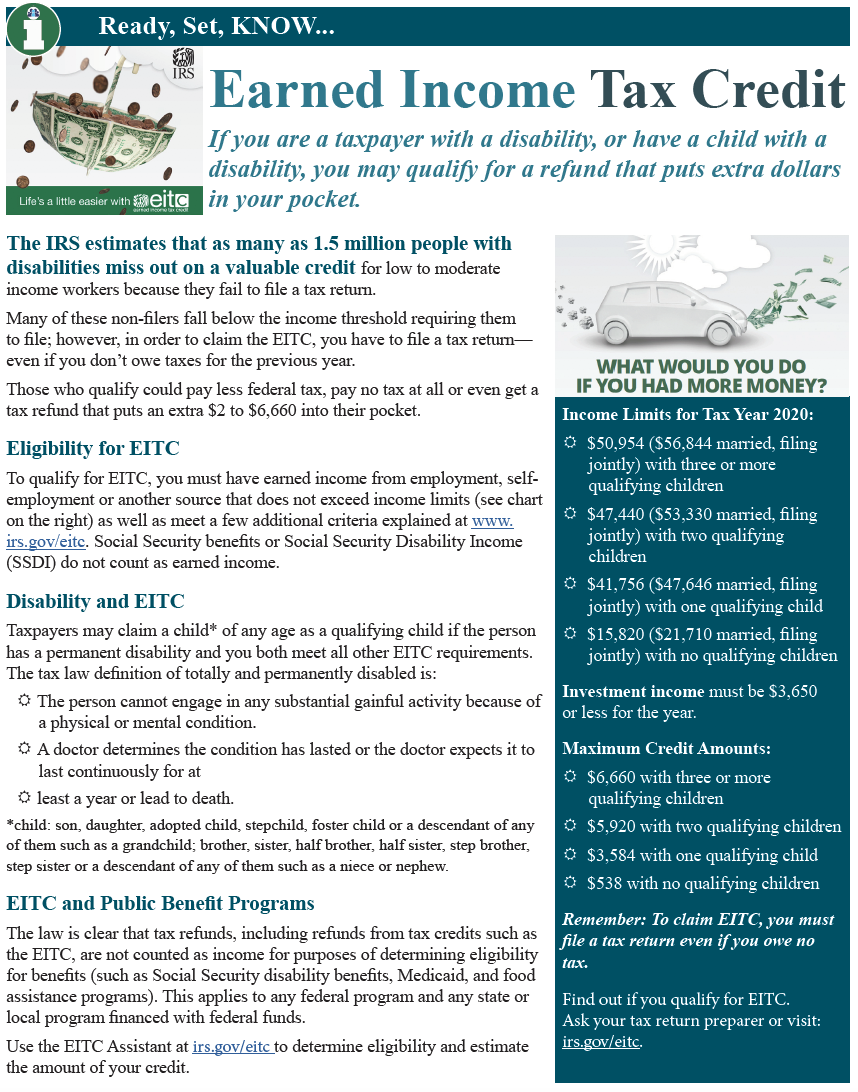

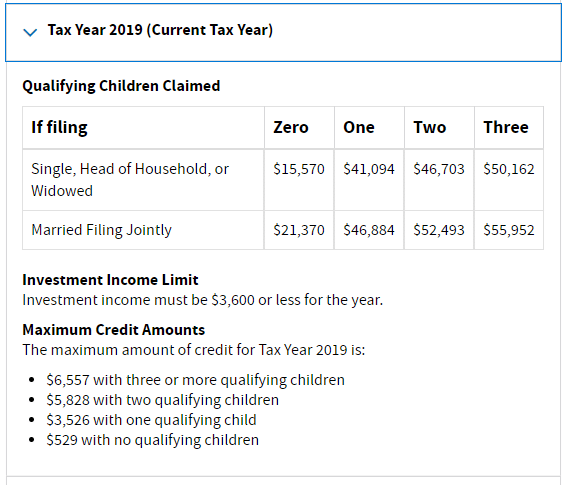

For many Americans it can be difficult to know which tax credits they qualify for and why. You use Schedule EIC to claim the EITC with one or more qualifying children maximum of three.

What Is The Earned Income Credit Check City

The dependent interview has changed in 2011.

. Claiming Child When Divorced. If you were eligible you can still claim the EITC for prior years. Dependents for Head of Household and EIC.

Report payments for these services on Schedule C or Schedule. Also for 2021 a specified student can claim the credit starting at age 24 and qualifying former foster youths and qualified homeless youths can claim the credit at age 18. Claim the EITC for Prior Years.

For example an individual will be disallowed the earned income credit if they claim when not eligible due to reckless or intentional disregard of the EIC rules In addition making fraudulent claims for the credit can disallow an individual for 10 years. Who Can You Claim. You can claim their children your grandchildren that live with you if your son or daughter does not claim them they live with you more than 12 of the year and your income is higher than your childs income.

If you have a qualifying child you must also file the Schedule EIC Form 1040 or 1040-SR Earned Income Credit to give us information about them. A tool that may help is Publication 3524 EITC Eligibility Checklist PDF or 3524 Spanish Version PDF. Notaries must report Notary fees as ordinary income but Notary fees are not subject to Self-Employment Tax and are usually declared on IRS Form SE.

Available at participating US. Filing as a Widower Kids and Taxes. But tax credits are worth having because they provide meaningful savings on a filers overall tax contribution and in some cases lead to an increased tax refund.

If the parents AGI is higher than the AGI of the grandparent the grandparent may not claim the child as a qualifying child for the EITC or other child-related. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns or if you select other products and services such as Refund Transfer. Dependents are added under the personal info tab.

You can find more information on this topic in Chapter 12 of the IRS Publication 17 listed as Notary Public beneath the Other Income category. Child and Dependent Care. One of the most beneficial and refundable tax credits for families with low or moderate incomes is the Earned.

You have three years to file and claim a refund from the due date of your tax return. Alimony and Child Support. Do you claim workers comp on taxes the answer is no.

If the parent of the child is the qualifying child of the grandparent the parent may not take the EITC.

Earned Income Tax Credit Don T Miss Out Informing Families

Eic Frequently Asked Questions Eic

Pin On Organizing Tax Information

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Summary Of Eitc Letters Notices H R Block

What Is The Earned Income Credit Check City

Earned Income Tax Credit Guidance 2021 Tax Filings Atlanta Cpa Firm

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

Earned Income Tax Credit For 2020 Check Your Eligibility

Who Qualifies For The Earned Income Tax Credit Eitc Or Eic And How Can I Claim It Taxmania

Form 11 Instructions 11 11 Ways Form 11 Instructions 11 Can Improve Your Business Worksheets Educational Worksheets About Me Blog

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc